Alright, everyone. Let’s calm down — it’s just a trade war!

A few weeks ago, President Trump signed executive orders imposing 25% tariffs on goods from Mexico and Canada, along with an additional 10% tariff on Chinese imports. He had been threatening it for a while, and most of us assumed it was just posturing.

I was in Monterrey with the team the week of January 27, leading up to the tariffs taking effect. Someone on our team asked me, “What happens to Cargado if these tariffs go through?”

I told him, “Before we go down any rabbit holes, let’s see what actually happens on Monday.” Based on how things played out during Trump’s first term, this felt like a pressure tactic—something meant to force a negotiation. I was pretty confident we’d have a resolution by Monday morning.

Well, Monday morning rolled around, and the tariffs were still in place.

Did freight stop moving? No. Supply chains don’t just pivot overnight. You can’t relocate an entire manufacturing operation in a weekend. Can companies shift to different suppliers? Sure, over time. But immediately? Not really.

That Sunday morning, I woke up to texts from people in logistics and manufacturing asking what to do. I’ve always focused more on moving freight than on tariffs and duties, but the two are obviously linked. I didn’t have a perfect answer, but I told them it seemed temporary.

I can’t read the President’s mind, but let’s break this down. The executive order cites illegal immigration and drug trafficking as the reasons for the tariffs. But we also have the USMCA, which was supposed to prevent tariffs between the U.S., Mexico, and Canada.

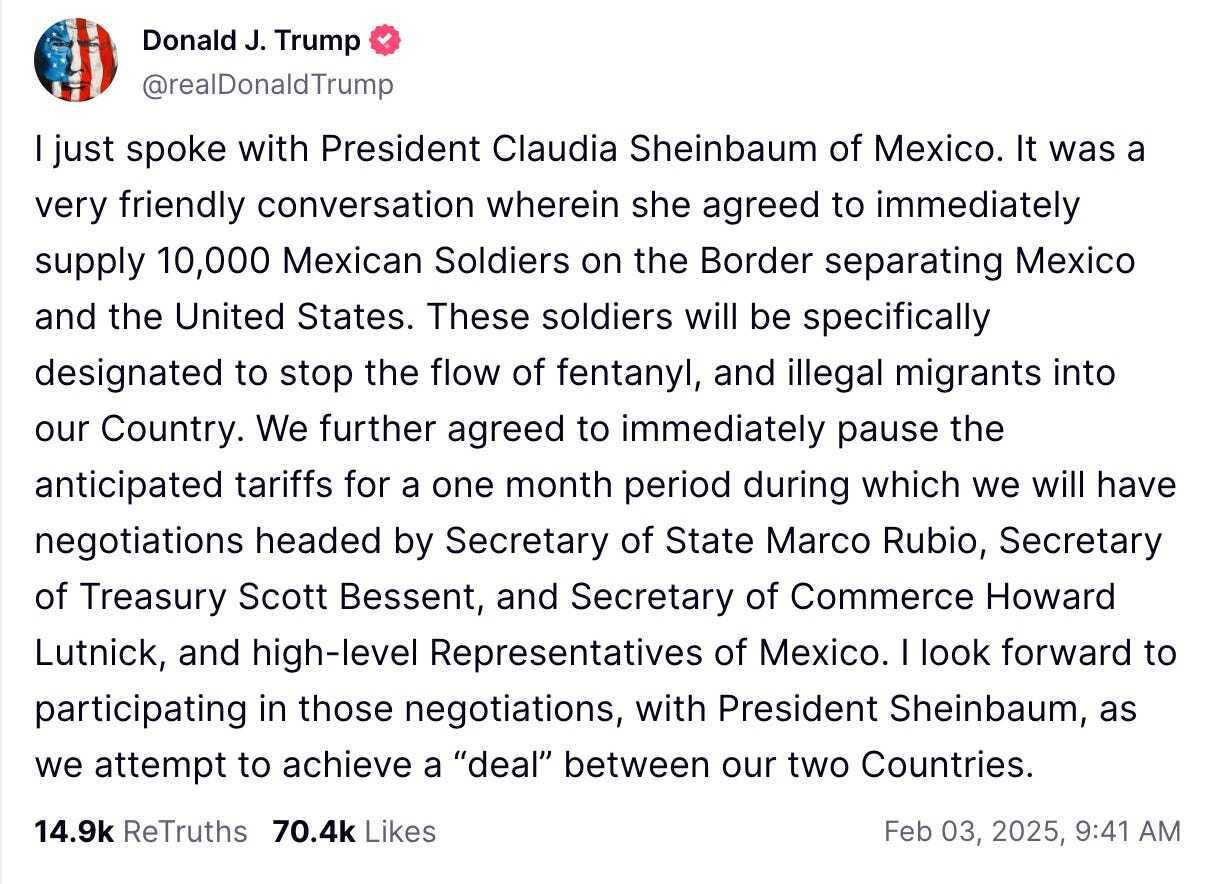

I started writing this newsletter over the weekend when it looked like the tariffs were happening. By Monday, Trump had announced a deal with Mexico to avoid them. But that was just a delay—not a cancellation. So let’s tackle some of the most common questions I’ve been getting.

1. Why tariffs?

There are two likely reasons Trump pulled this move.

First, there’s the trade deficit. In 2024, $840 billion worth of goods moved between the U.S. and Mexico. The U.S. exported $334 billion to Mexico, while Mexico exported $506 billion to the U.S., leaving a $152 billion trade deficit. Trump has always treated trade deficits as if they mean we’re “losing” to another country — ignoring the fact that the U.S. economy is 16 times the size of Mexico’s. If Mexico could afford to buy more from us, they would.

Second, and more realistically, Trump wanted Mexico to agree to something. That “something” turned out to be a commitment to send 10,000 troops to the border to curb fentanyl trafficking and illegal immigration. But this is likely just the beginning — expect USMCA renegotiations to kick off in the next few months.

2. What happens to trade between the U.S. and Mexico if tariffs on Mexico go into effect?

It gets messy. Mexico would retaliate with tariffs on U.S. goods.

Most U.S. exports to Mexico are raw materials sent south for cheaper assembly before being shipped back as finished products. It’s not just Americans buying tons of Mexican goods—it’s an integrated supply chain.

Now, imagine you’re the VP of Transportation at a major manufacturer or retailer. You just got hit with 25% tariffs, and your CFO calls a leadership meeting. He lays out two options:

Pass the cost onto consumers — raise prices across the board.

Push the cost down to suppliers—renegotiate prices with vendors, suppliers, and logistics partners.

You can only squeeze raw material costs so much. But you can go to your transportation team and demand lower freight costs. That’s where logistics companies will have to step up, reducing price risk and optimizing capacity. More freight will hit Cargado as companies look for cost-effective coverage.

3. What’s going to happen long term with trade between the U.S. and Mexico?

Not much. North American trade isn’t going anywhere. The U.S. has always had a strong relationship with its neighbors, and major companies have been deeply invested in Mexico for decades.

Automakers like General Motors, Ford, Stellantis, and Volkswagen have massive manufacturing operations in Mexico. So do Caterpillar, John Deere, Whirlpool, and Honeywell. These companies rely on Mexico for production, not just because of cost savings but because of supply chain efficiencies, proximity to the U.S. market, and access to skilled labor.

Could they move their operations somewhere else? Maybe, but not anytime soon. Shutting down a factory and relocating production isn’t like flipping a switch—it takes years of planning, billions of dollars in investment, and a reliable labor force in the new location.

Is this the way most leaders negotiate—throwing out threats on social media? No. Does Trump love using his microphone to drive a deal? Absolutely. He’s setting the stage to renegotiate USMCA again. When the dust settles, the deal will probably look a lot like what we have now, with just enough tweaks for the U.S. to claim a win.

The bottom line.

This was mostly a pressure play to get Mexico and Canada to concede on something now and set up a USMCA update by the end of 2025. We’ll see how it plays out in the coming months.